All plenary sessions will be available to watch on demand in the APPEA Portal post event.

Times listed below are in AEDT (11.30am AEDT | 10.30am AEST | 8.30am AWST)

Plenary 1: What’s attracting the ATO’s Attention?

Tuesday, 12 October 2021 | 11.30am – 12.30pm AEDT | Virtual Presentation

This plenary will see the ATO provide an update on its assurance and guidance work programs, whilst also providing an update on matters that are attracting the ATO’s attention for companies operating in Australia’s oil and gas industry including updates on the Glencore decision and independent review.

Joining this plenary will be Deputy Commissioner Rebecca Saint, and Assistant Commissioners Stan Spasojevic and Jonathan Chamarette. Facilitated by Origin Energy’s General Manager of Tax and APPEA Tax Committee Member Therese Stephenson, the session will also include a government address from Senator the Hon Simon Birmingham.

Australian Government Address

Senator the Hon Simon Birmingham

Minister for Finance, Leader of the Government in the Senate, Senator for South Australia

(Pre-recorded message)

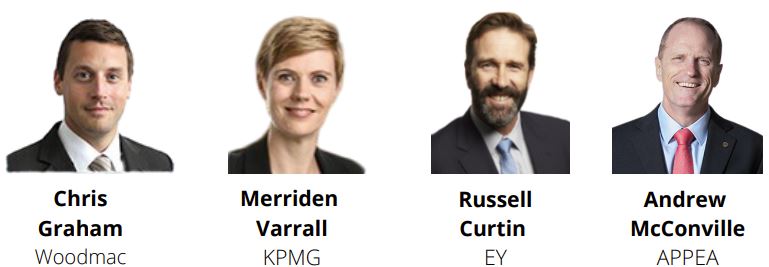

Plenary 2: Global mega trends impacting Australia’s oil and gas industry

Tuesday, 19 October 2021 | 11.30am – 12.30pm AEDT | Virtual Presentation

This plenary will explore four major trends driving geopolitical shifts and the lasting effects these may have on Australian businesses and Australia’s oil and gas sector. The plenary will explore structural shifts in the international system including the USA-China strategic competition, global dissatisfaction and distrust, technology disruption, climate change, and the changing role of China in its trade relationships with Australia.

KPMG Specialist Tax & Commercial Satellite Hub

Tuesday, 19 October 2021

11.30am – 12.30pm AEDT | Option to watch the APPEA virtual plenary session in the KPMG onsite hub locations, before the KPMG sessions commence

12.30pm – 1.00pm AEDT | In-person networking with light refreshments before presentations

1.15pm – 2.15pm AEDT | Presentations only – both in-person OR virtually

Join us either either virtually or in-person in Perth after the APPEA plenary session for business networking, and to hear the latest from KPMG’s tax & commercial specialists.

Session topics include:

- Mobility: Attracting and retaining the right people, in the right place, at the right time

- Decommissioning: Navigating an evolving decommissioning landscape – a tax and accounting perspective

- Mergers, Acquisitions and Divestitures: Beyond synergies, what are the tax considerations in M&A?

Click here for session information and featured speakers

Plenary 3: There is more to ESG than C – why climate change is not the only factor in investor decision making

Tuesday, 26 October 2021 | 11.30am – 12.30pm AEDT | Virtual Presentation

This plenary will explore the growing importance of environmental, social and governance factors in attracting investment. It will examine why there is more to ESG than climate change targets and what other factors are being considered in the investment environment.

PwC Specialist Tax & Commercial Satellite Hub

Tuesday, 26 October 2021

11.30am – 12.30pm AEDT | Option to watch the APPEA virtual plenary session in the PwC onsite hub locations, before the PwC sessions commence

12.50pm – 4.00pm AEDT | Presentations only – both in-person OR virtually

Session topics include:

-

-

-

-

-

-

- Transfer Pricing and Glencore

- OECD Pillar 2

- Contemporary Tax Issues

-

-

-

-

-

Click here for session information and featured speakers